Airplane Seat Switching and The Endowment Effect

Having Empathy and Understanding Our Own Fallacies

Let’s talk about airplane seat switching and the endowment effect.

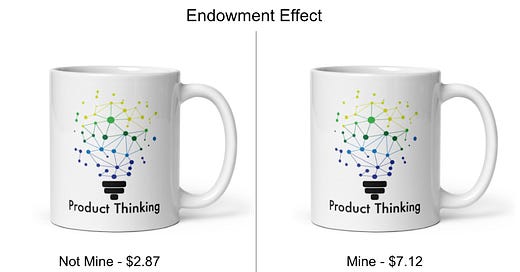

The Endowment Effect

The endowment effect is the psychological finding that people value things they own more than things they don’t. So, once you have something, you feel like it is worth more than when you don’t have it. So, if I gave you a cup, suddenly it would be worth more to you. You may not have wanted a cup at all, and may not have considered buying one, but would be loath to part with it even if I offered to buy it from you for a reasonable price after I had given it to you.

Sometimes this idea is also referred to as loss aversion.

“Loss aversion is a cognitive bias that describes why, for individuals, the pain of losing is psychologically twice as powerful as the pleasure of gaining. The loss felt from money, or any other valuable object, can feel worse than gaining that same thing. Loss aversion refers to an individual’s tendency to prefer avoiding losses to acquiring equivalent gains. Simply put, it’s better not to lose $20, than to find $20.”

In one of my favorite books, Thinking Fast and Slow, Daniel Kahneman used the very experiment that I described above with the cup. They went to various universities and gave mugs out to classes. Students could then buy and sell. But once half the students in the class owned the mug, the results were dramatic:

“We conducted a similar market for an object that we expected people to value for use: an attractive coffee mug…The mug was the worth about $6. Mugs were distributed randomly to half the participants. The Sellers had their mug in front of them, and the Buyers were invited to look at their neighbor’s mug; all indicated the price at which they would trade. The Buyers had to use their own money to acquire the mug. The results were dramatic: the average selling price was about double the average buying price, and the estimated number of trades was less than half the number predicted by standard theory. The magic of the market did not work for a good that the owners expected to use.”

Airplane Seats

So, what does that have to do with airplane seats?

Keep reading with a 7-day free trial

Subscribe to Prodity: Product Thinking to keep reading this post and get 7 days of free access to the full post archives.